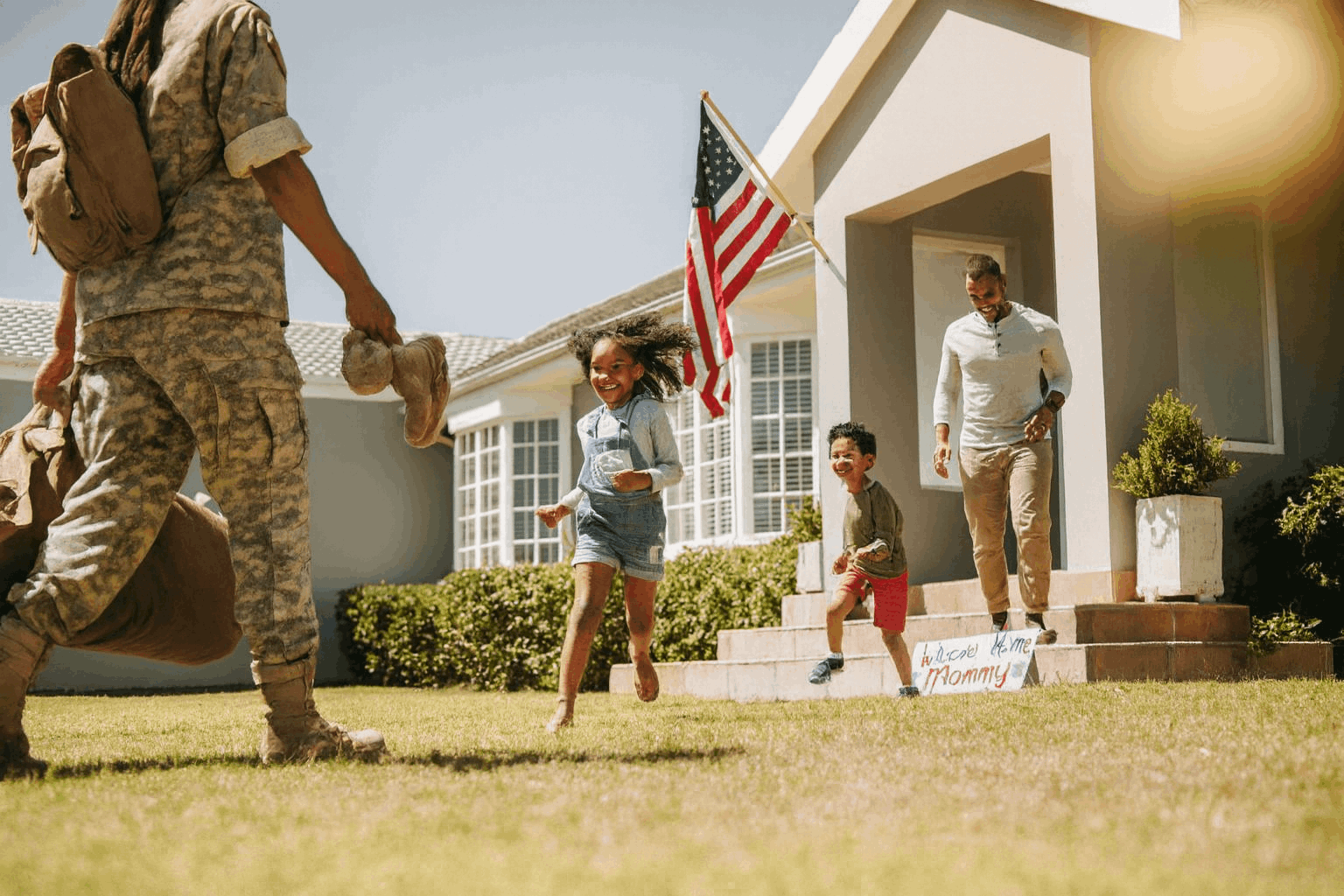

Get VA loans in Michigan with $0 down and competitive rates. REIF Loans helps veterans and active-duty members secure affordable VA home financing.

If you’ve served our country, you’ve earned access to one of the best home financing programs available. VA loans, backed by the U.S. Department of Veterans Affairs, help veterans and active-duty service members buy, build, or refinance a home with no down payment and flexible credit terms.

At REIF Loans, we take pride in helping Michigan’s veterans use their VA loan benefits to achieve homeownership with clarity, respect, and transparency.

A VA loan is a government-backed mortgage program designed to make homeownership more accessible for eligible U.S. military service members, veterans, and surviving spouses.

Instead of requiring large down payments or strict credit standards, VA loans offer affordable terms supported by the Department of Veterans Affairs.

These benefits make VA loans one of the most affordable home financing options in Michigan.

Before applying, it’s important to confirm that you meet the service and credit requirements for a VA loan. REIF Loans helps you verify eligibility and gather documentation quickly.

Our team assists you in obtaining your COE and completing your application efficiently.

VA loans were built to honor your service by removing financial barriers to homeownership. Michigan veterans benefit from flexible approval criteria and cost-saving features that conventional loans can’t match.

VA loans provide a path to long-term financial stability for Michigan’s military families.

Applying for a VA loan is simple with the right guidance. At REIF Loans, we walk you through every step, from verifying eligibility to closing your home purchase.

We’ll help you request it directly from the VA.

Learn your estimated loan amount and rate.

Choose a property that meets VA guidelines.

Provide income and asset verification.

We coordinate with the VA-approved lender.

Enjoy homeownership with your VA benefits.

VA loans aren’t just for first-time buyers. Michigan veterans can also refinance or access equity through two popular programs..

Also known as the VA Streamline Refinance, this program lets you lower your rate with minimal documentation and no appraisal in most cases.

Allows you to tap into your home’s equity for renovations, debt consolidation, or other financial goals.

Both refinance options are backed by the same strong VA protections and favorable terms.

VA loans are for primary residences only, but you can reuse your benefit for a new primary home.

Yes, but they are typically lower, and sellers can cover up to 4% of your costs.

Yes, through a VA cash-out refinance.

Most lenders prefer 620+, but VA guidelines allow flexibility based on overall credit profile.

No, VA loans do not require monthly PMI.

If you’re a Michigan veteran or active-duty service member, you’ve earned this benefit. REIF Loans is here to help you use it confidently. Our VA loan specialists make every step clear and manageable.

REIF Loans provides VA loan services for eligible veterans, active-duty military members, and surviving spouses across the state of Michigan. Loan approval and terms are subject to VA and lender guidelines. Information on this page is for educational purposes only and does not constitute an offer to lend. Please contact REIF Loans directly to confirm licensing and eligibility for your location.